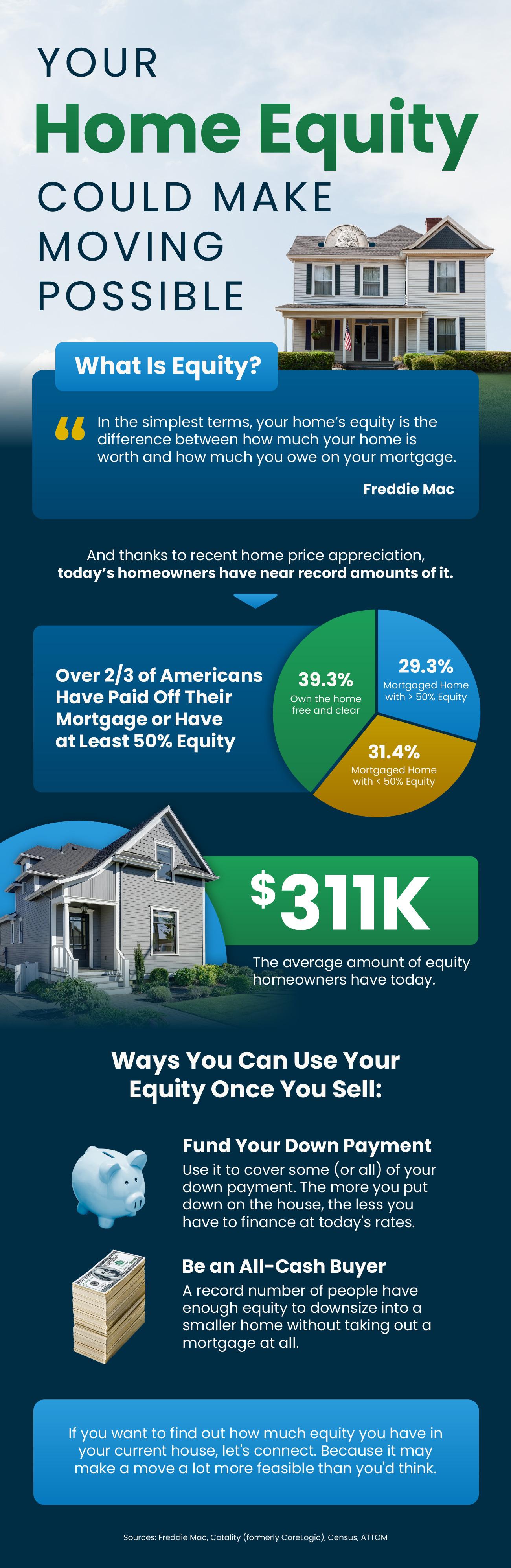

Your Home Equity Could Make Moving Possible

Some Highlights

- Thanks to recent home price appreciation, homeowners have near record amounts of equity – and you may too. On average, homeowners have $311K worth of equity.

- Once you sell, you can use it to fund your down payment on your next home or maybe even to buy a smaller house in cash.

- If you want to find out how much equity you have, connect with an agent. Because it may make a move a lot more feasible than you'd think.

Recent Posts

Are Big Investors Really Buying Up All the Homes? Here’s the Truth.

The #1 Regret Sellers Have When They Don’t Use an Agent

The Credit Score Myth That’s Holding Would-Be Buyers Back

Expert Forecasts Point to Affordability Improving in 2026

Thinking about Selling Your House As-Is? Read This First.

Why Pre-Approval Should Be Your First Step – Not an Afterthought

More Buyers Are Planning To Move in 2026. Here’s How To Get Ready.

Not Sure If You’re Ready To Buy a Home? Ask Yourself These 5 Questions.

Reasons To Be Optimistic About the 2026 Housing Market

Turning a House Into a Home: The Benefits You Can Actually Feel

Whether you're trying to buy your dream home or selling your current one, LPT Realty's number one priority is to help find you the best deal possible while providing exceptional customer service. LPT Realty agents are armed with best in class technology and marketing tools to help you make informed decisions about buying or selling your home, and are there for you every step of the way.