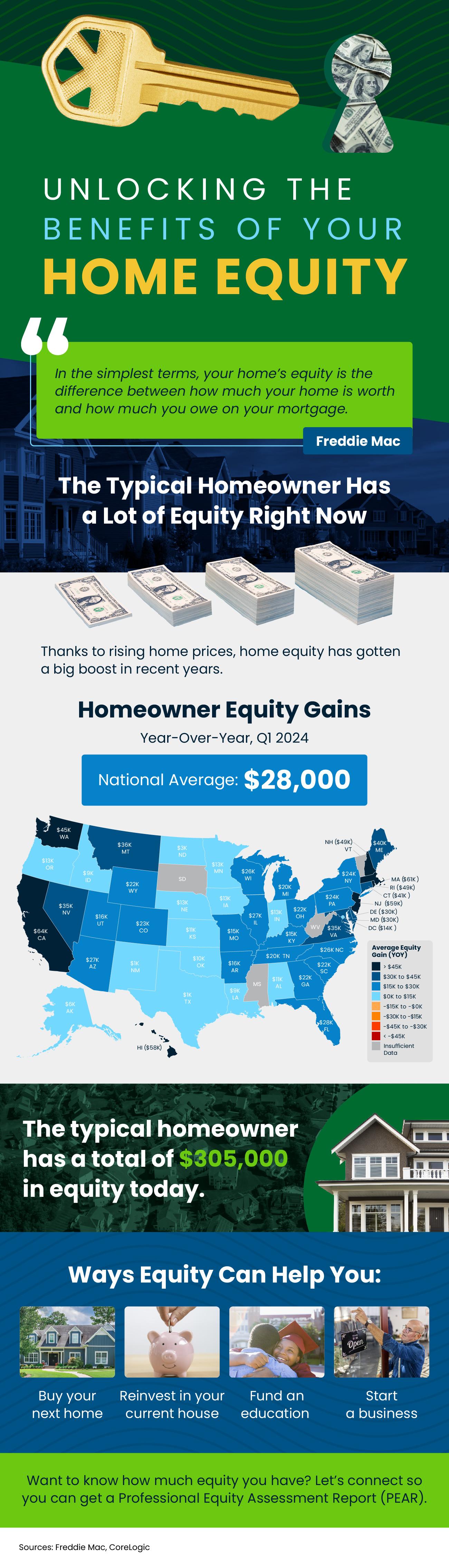

Unlocking the Benefits of Your Home's Equity

Some Highlights

- Equity is the difference between what your house is worth and what you still owe on your mortgage.

- The typical homeowner gained $28,000 over the past year and has a grand total of $305,000 in equity. And there are a lot of great ways you can use that equity.

- To find out how much equity you have, connect with a real estate agent who can give you a Professional Equity Assessment Report (PEAR).

Recent Posts

Why More Sellers Are Choosing To Move, Even with Today’s Rates

What You Really Need To Know About Down Payments

Why Most Sellers Hire Real Estate Agents Today

You May Have Enough Equity To Downsize and Buy Your Next House in Cash

Your House Didn’t Sell. Here’s What To Do Now.

Is Inventory Getting Back To Normal?

The Five-Year Rule for Home Price Perspective

Buying Your First Home? FHA Loans Can Help

The Big Difference Between a Homeowner’s and a Renter’s Net Worth

The Rooms That Matter Most When You Sell

Whether you're trying to buy your dream home or selling your current one, LPT Realty's number one priority is to help find you the best deal possible while providing exceptional customer service. LPT Realty agents are armed with best in class technology and marketing tools to help you make informed decisions about buying or selling your home, and are there for you every step of the way.