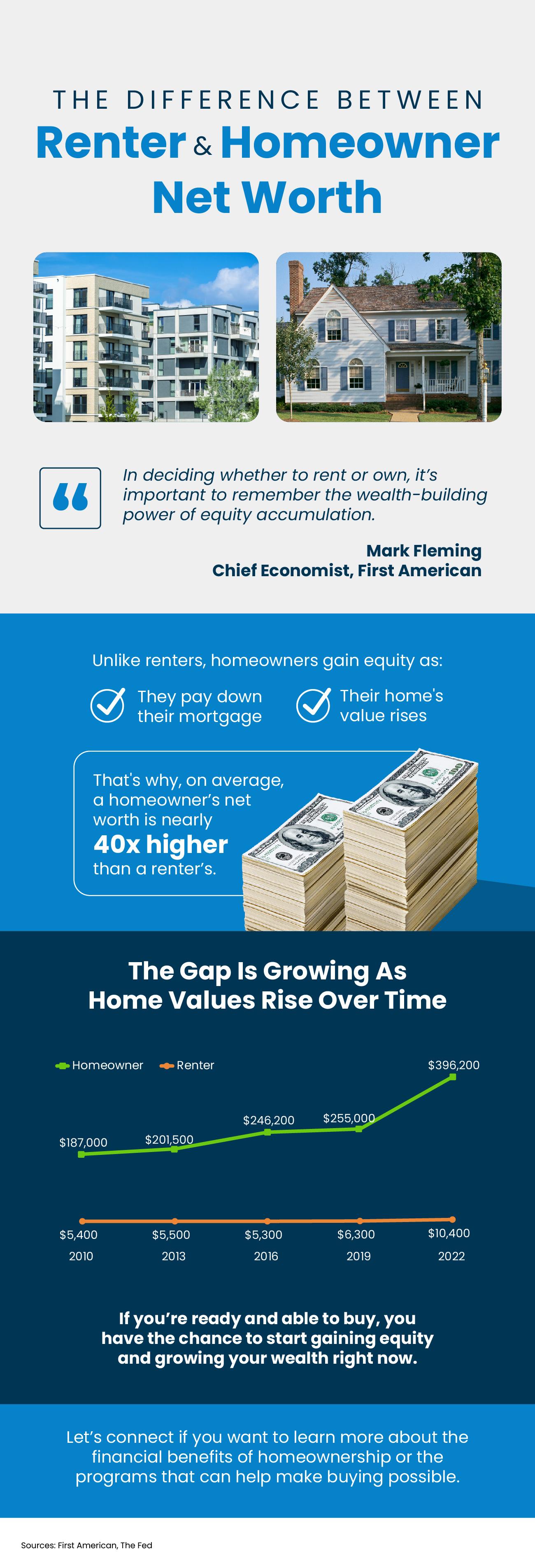

The Big Difference Between Renter and Homeowner Net Worth

Some Highlights

- If you’re torn between renting or buying, don’t forget to factor in the wealth-building power of homeownership.

- Unlike renters, homeowners gain equity as they pay their mortgage and as home values rise. That’s why, on average, a homeowner’s net worth is nearly 40x higher than a renter’s.

- Connect with an agent if you want to learn more about the financial benefits of homeownership or the programs that can help make buying possible.

Recent Posts

Are Big Investors Really Buying Up All the Homes? Here’s the Truth.

The #1 Regret Sellers Have When They Don’t Use an Agent

The Credit Score Myth That’s Holding Would-Be Buyers Back

Expert Forecasts Point to Affordability Improving in 2026

Thinking about Selling Your House As-Is? Read This First.

Why Pre-Approval Should Be Your First Step – Not an Afterthought

More Buyers Are Planning To Move in 2026. Here’s How To Get Ready.

Not Sure If You’re Ready To Buy a Home? Ask Yourself These 5 Questions.

Reasons To Be Optimistic About the 2026 Housing Market

Turning a House Into a Home: The Benefits You Can Actually Feel

Whether you're trying to buy your dream home or selling your current one, LPT Realty's number one priority is to help find you the best deal possible while providing exceptional customer service. LPT Realty agents are armed with best in class technology and marketing tools to help you make informed decisions about buying or selling your home, and are there for you every step of the way.